COVID-19 Accelerates Digital Banking Shift In The Philippines

- Almost one-third of Filipino adults are expected to have a digital-only bank account by 2025

- Around 10.2 million Filipinos adults (15%) have a digital-only bank account

- A further 10.8 million (16%) plan on opening one, meaning almost one-third could have one by 2025

- Finder’s global fintech editor Elizabeth Barry says the coronavirus pandemic could accelerate digital banking adoption

Digital banking is set to boom in The Philippines, with almost a third of Filipino adults expected to have an account by 2025, according to new research from global financial comparison platform Finder.com.

Survey results reveal an estimated 10.2 million Filipinos, approximately 15 percent of the adult population, currently have a digital-only bank account, with 10.8 million more (16%) planning to open an account in the next 5 years.

Global fintech editor at Finder.com, Elizabeth Barry, says the Coronavirus pandemic will likely act as a catalyst for the digitisation of banking.

“Restricted movement means that what was once forecasted for the next five years could be squeezed into a much shorter time frame,” Barry says.

While the data suggests the Philippines has been slow on the uptake for digital banking, Barry noted the Philippines actually has one of the highest projected rates of adoption among the 13 countries included in the study.

“India is the only country that is expected to see its rate of adoption grow by more percentage points in the next five years than the Philippines, while countries like France and Ireland are expected to see slower growth”, she commented.

India is expected to see the biggest boom (21% increase), followed by Brazil, Malaysia, and the Philippines (16%).

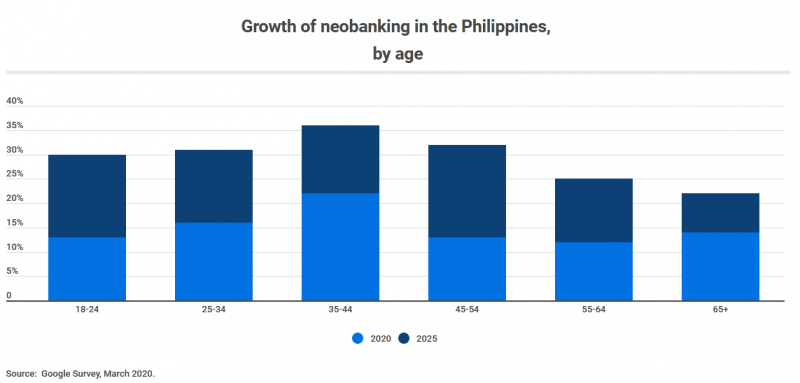

To see the full report, including a breakdown by age, gender and region, visit https://www.finder.com/ph/digital-banking-statistics